As it stated in Key HighlightsGold price corrected higher, but it failed to break the $1,265 resistance against the US Dollar. There is a key bearish trend line formed with resistance near $1,264 on the 4-hours chart of XAU/USD. Gold Price Technical AnalysisAfter a major decline, gold price found support near the $1,237 level against the US Dollar. The 4-hour chart points that the price was capped by the $1,265 resistance and the 100 simple moving average (red, 4-hours). On the upside, the price must clear the trend line and the $1,265 resistance to set the pace for more gains.

collected by :kiven Dixter

Gold Price Framework Vol. 2: The Energy Side Of The Equation - Part II

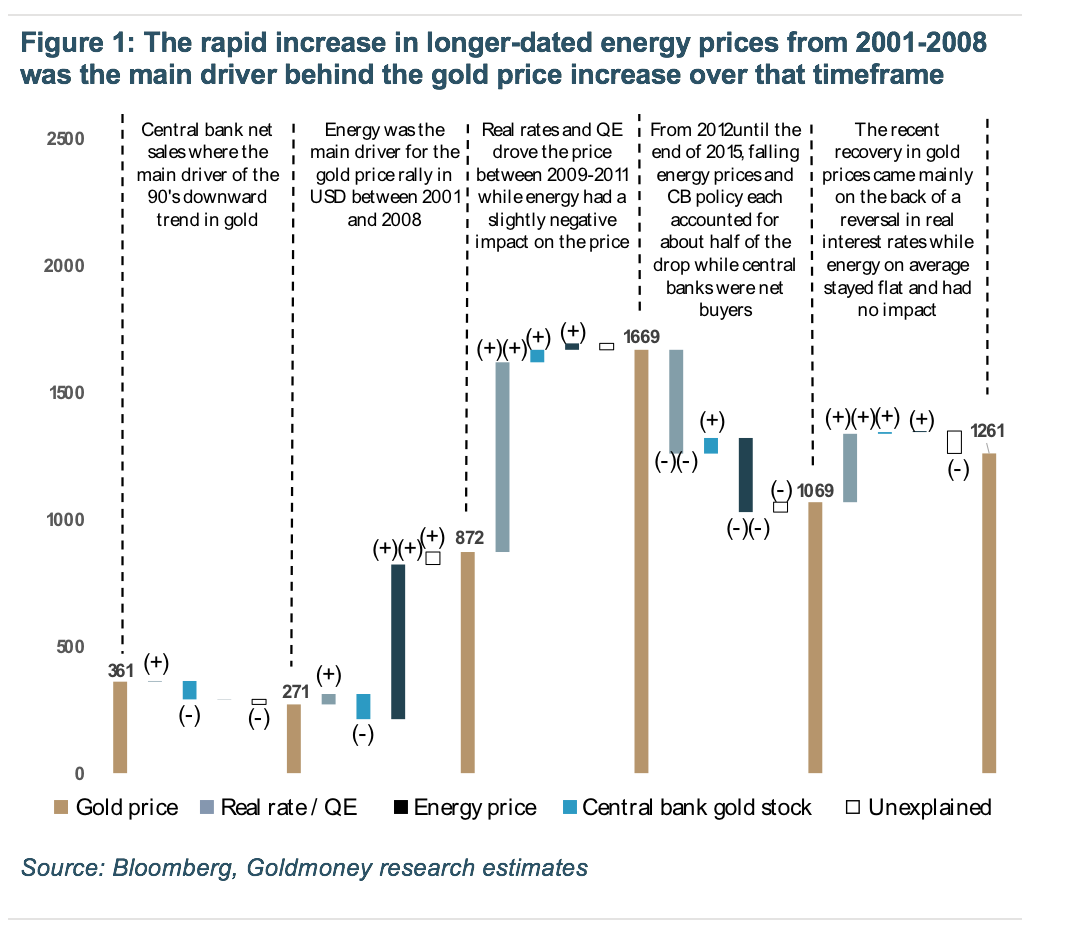

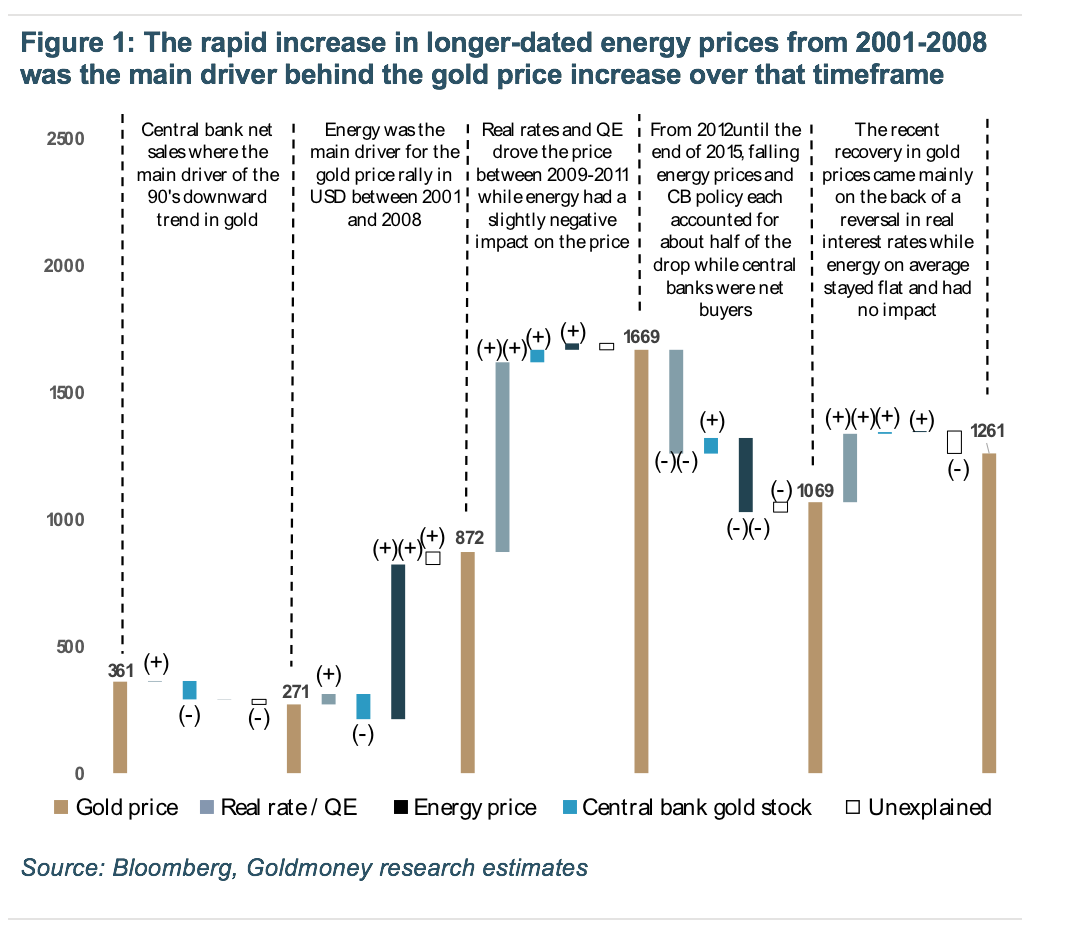

This is in line with the findings of part I of our gold price framework which showed that a 1% change in longer-dated energy prices impacts gold prices by about 0.5%. Again, energy costs have gone up significantly since 1997, specifically fuel costs which means the energy costs are likely >50% of the costs of producing limestone today. In order to explain this, we have to recall some of the concepts we discussed in our first gold price framework (Gold Price Framework Vol. Gold prices only move in line with energy prices to the extent that gold producers are exposed to the instant cost change. In 2016 we published a report (Inverted Asymmetry - Gold Price Outlook, September 20, 2016) in which we used our original gold price framework to identify the price drivers of the gold cycles since 2001.

Gold Price Prediction – Gold Tumbles as White House Introduces New Chinese Tariffs

As it stated in Gold prices tumbled as the White House announced a list of tariffs on China that totals $200 billion. The list of 10% tariffs on $200 billion in Chinese goods, as the president's recent threats to escalate a broadening trade war with Beijing came to fruition. The tariffs will not go into effect immediately but will undergo a two-month review process, with hearings Augusts 20-23. {alt}ECB's Villeroy Said that an ECB rate hike possible through summer 2019ECB's Villeroy Said that an ECB rate hike possible through summer 2019. This ties in with recent source stories suggesting a rate hike possibly in September/October, rather than the December.collected by :kiven Dixter

Comments

Post a Comment