as informed in Wholesale gold bullion bars bounced nearly $10 per ounce from $1304.50 as world stock markets failed to follow Wall Street higher & great Gov bond prices fell, driving longer-term interest averages higher. The yield offered with 10-year America Treasury debt rose back near 4-year highs above 3.0% for the 2nd time in a fortnight, When crude oil prices jumped 2.5% to fresh 3.5-year highs above $70 per bbl of America benchmark WTI. That pushed the ratio of gold priced in barrels of crude oil drop to 18.5 – its lowest standard ever late 2014. The jump in crude oil prices too chock the energy-importer currencies of great gold-consumer nations India & Turkey on the foreign interchange market. "The premier risk-off sentiment next President Trump's Iran declaration [soon] dissipated," tells today's Asian trading note from Swiss refiners & finance group MKS Pamp.

collected by :kiven Dixter

Gold value Erases final Week's Drop, Platinum at $400 sale as S.African Miners Struggle

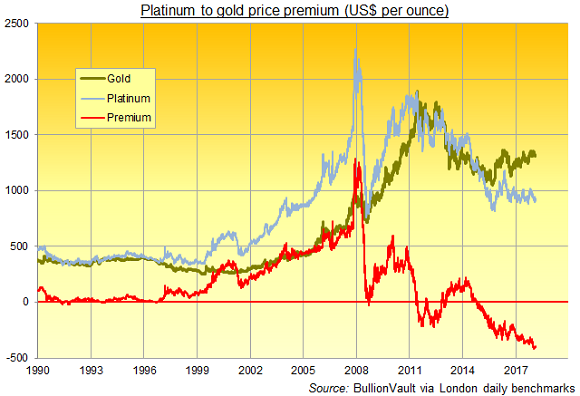

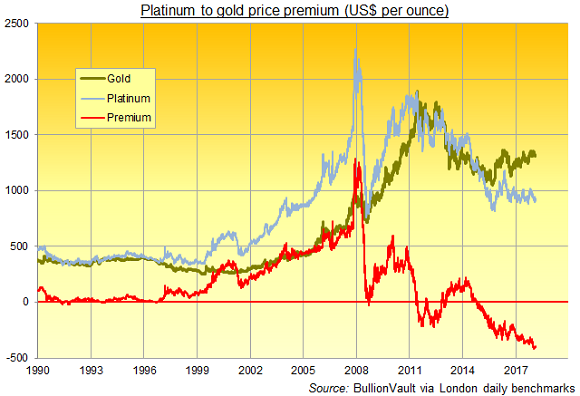

GOLD PRICES lagged silver & platinum however neared their 1st every week earn in 4 against the $ on Friday, erasing final week's 0.8% loss to trade at $1324 per ounce. Silver doubled gold's week-on-week $ earn to add 1.5%, touching its top intra-day value ever 23 April at $16.80 per ounce. Prices to purchas platinum bars rose further steeply still, adding 1.8% for the 7 days in America $ terms to peak at $928. Ahead of Monday's begain to London's annual Platinum 7 days of seminars, events & business meetings however, which continue left platinum prices near a $400 per ounce sale against gold. Crude oil held Friday near this week's fresh 3.5-year highs, trading above $77 per bbl of Eu benchmark Brent.

UK Interest averages Below Inflation for Longest in seven Decades, Sterling value to purchas Gold Jumps

referring to BUY GOLD prices jumped to 4-month highs against the English Pound in London trade Thursday after the Bank of Britain failed to increase Britain interest averages yet again, in spite of inflation continuing to exceed its formal aim of 2.0% per year. Prices for Eurozone Businessmen wanting to purchas gold too rose again, re-touching Wednesday's fresh 6-month highs above €1109 per ounce. Across the final ten years, Britain interest averages have this day matched or exceeded the pace of consumer-price inflation in just 23 of 120 months. Major Gov bond prices too rose Thursday, nudging longer-term interest averages reduce & pulling 10-year America Treasury yields back below 3.0%. Investor request for gold-price exposure out of exchange-traded trust funds slipped on Wednesday, by the SPDR Gold Trust (NYSEArca:GLD) needing two fewer tonnes of bullion to back its shares at 862 tonnes.Gold value Forecast: Key backing going to remember in Focus

Gold value Forecast: Key backing going to remember in FocusDollar Dominance Information Systems liable to trigger more losses for gold this week, although a stronger-than-expected unite states CPI report perhaps be needed to break key backing near $1,300 per ounce. Gold registered internet losses final week, primarily under the effect of $ gains, although there was backing at four-month lows only above the key backing standard of $1,300 per ounce. Comments tending to reinforce guess which higher inflation going to be tolerated would tend to backing gold. Further downward Stress on equities would tend to provide some defensive gold support. If the unite states decides to pull through the agreement, underlying danger appetite going to likely stumble, which would too provide internet gold support.

Standard Chartered: Floor For Gold value To save Rising

Standard Chartered tells "the floor for prices has risen" in the gold market without requiring significant physical request to cushion the downside. The precious metal remembers range-bound – although at the reduce finish of the band – however value dips haven't been deepened with a soft physical market, the bank says. Analysts tell the weakness earlier Thursday was because of the unite states dollar, that on a trade-weighted foundation climbed to a 4½-month high next Trump's decision. "If economic relations with Iran are pending another time nonetheless, Iran can decide to relaunch its nuclear weapons program. This latent geopolitical danger ought lend backing to the gold price, in our view." As of 9:22 a.m. EDT, Comex June gold was sixty cents higher at $1,314.30 an ounce however earlier traded as low as $1,304.20.collected by :kiven Dixter

Comments

Post a Comment