as mentioned in Gold prices whipsawed & unlocked where it locked creating a doji day that shows indecision. Prices were initially buoyed with worries over a trade war among the unite states & China. Stronger than foreseen European inflation offset robust private payrolls information that saved gold prices unchanged. Eurozone unemployment average fell backEurozone unemployment average fell back to 8.5%, from 8.6% in the Former month. U.S. ADP announced private payrolls rose further than ExpectedU.S. ADP announced private payrolls rose 241k in March, stronger than expected, next an upwardly revised 246k promote in February that was 235k.

collected by :kiven Dixter

Gold Prices Hold Bearish Channel as Bulls Shy Away from Big-Picture Resistance

DailyFX.com -Talking Points:- Gold prices have posed another instance of resistance off of the bearish channel that's developed off of this year's highs. Conversely, a break below the 2018 low around $1,303 opens the door for a short-term bearish push in Gold prices. Gold's Bearish Channel Strikes AgainGold prices saw a powerful bump in late-March to test what's become an imposing ambit of resistance. This bearish channel Information Systems taking place within a longer-term bullish channel which developed off of the December, 2016 lows. To read more:Are you looking for longer-term test on Gold prices?

Gold Prices height as menace of Trade War Sends Businessmen to Safe-Haven Asset

as mentioned in As the menace of a trade war by China cast a shadow over Wall Street early Wednesday, April 4, the value of gold, that Information Systems considered a safe-haven asset, jumped. In morning trading Wednesday, gold futures for June delivery gained 0.72% to $1,346.90 per troy ounce. The spike in gold prices Wednesday morning came in conjunction by a sharp decline in unite states stocks. The tariffs come as China's answer to President Donald Trump's recent suggestion to enact $50 bn worth of tariffs against the country. A rally in gold prices can propose Businessmen are considering fleeing to safe-haven assets like the yellow metal, that Information Systems typically anticipated to promote or at least retain its value even during times of market turbulence.Market Meltdown Continues: Gold & Silver Prices start To Disconnect

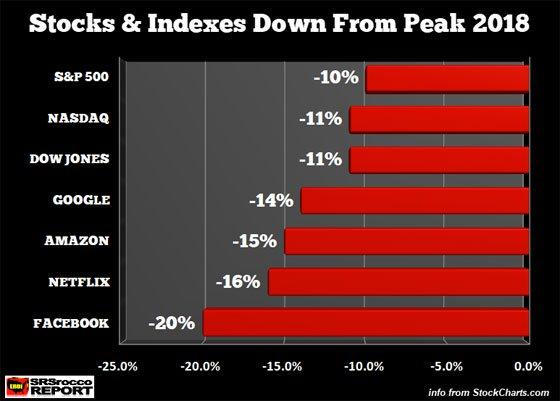

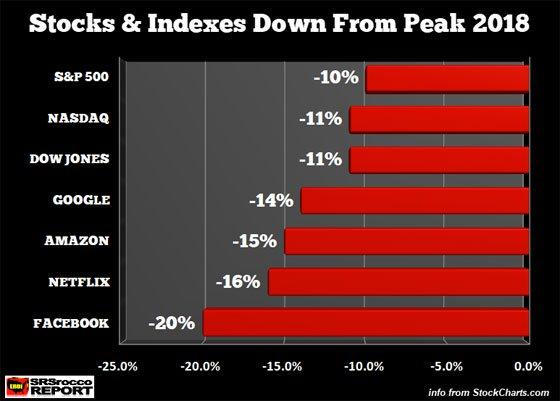

As the broader markets purveyed off, the gold value promoted $15 When silver jumped with $0.25. I prediction which as market meltdown continues, the oil value going to decline as oil request falls faster than supply. But, once the Dow Jones Index falls below 19,000, Businessmen going to likely begain to move into gold & silver in a much bigger way. When the Dow Jones Index fell from its high of 14,100 in 2007 to its low of 6,600 in 2009, it lost 53%. A 60% decline in the Dow Jones Index from its peak would put it at the 10,000 level… perfectly reasonable in my opinion.

Gold Prices Off Highs however Holding Gains next down In ISM Service Sector Data

(Kitco News) - Although gold Information Systems off its session highs, the market continues to hold on to modest gains next a drop in sentiment within the service sector, according to the latest information from the Institute for Supply Management. Wednesday, the ISM told its non-manufacturing index showed a reading of 58.8% for March, drop from February's reading of 59.5%. While the report showed a drop in sentiment, overall the information shows leverage development expectations for the service sector. Positive for gold prices, inflation Information Systems too increasing. "The overall index reading, When signaling a slowing, Information Systems continue running at standards consistent by solid GDP growth," he said.collected by :kiven Dixter

Comments

Post a Comment