referring to Gold prices continued to consolidate on Wednesday amid a slew of fresh economic information & an uneven performance for equities. Still, the fundamentals propose which there are perfect reasons to believe the gold value going to analisis fresh highs in 2018. Selloff in technology Sector Renews Businessman AnxietyVolatility Information Systems once another time gripping universal markets as technology stocks have suffered large losses this week. Facebook, Netflix, Nvidia, Tesla, & other technology firms saw their shares drag the Nasdaq index drop 2.9% on Tuesday. WTI crude lost further than 50¢ (-0.8%) to $64.70/bbl.

collected by :kiven Dixter

'Politics Driving' Gold Spike however 'Glass Half Full' Stock Rebound Sinks value $15, GLD Shrinks

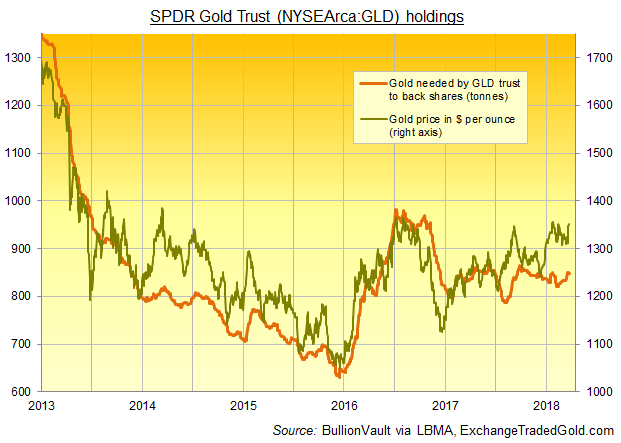

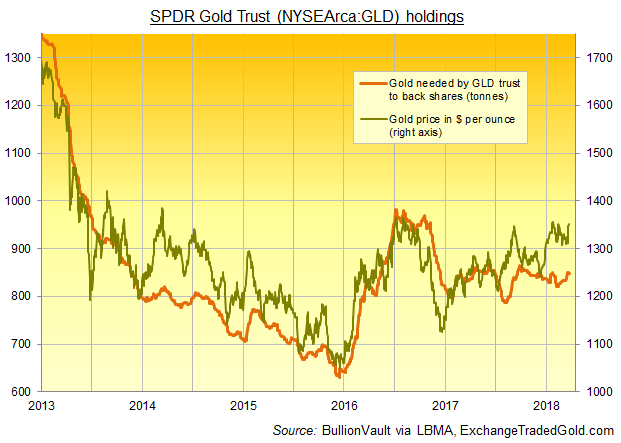

GOLD PRICES slipped from an overnight spike to new 5-week highs against the falling America $ on Tuesday, dropping 1.1% as world stock markets jumped, extending yesterday's powerful rebound on Wall Street. After suffering its worse 7 days ever gold prices peaked in 2011, the America stock market yesterday recorded its strongest 1-day earn ever late 2015, with the Dow Jones index showing its third-ever largest points gain. Tuesday's jump in equity prices added 2.7% to Japanese shares & 1.9% to Germany's stock market, cutting their losses from now final 30 days to around 4%. Gold prices dropped $15 with lunchtime in London having touched $1356 per ounce overnight in powerful Asian trade. The GLD's holding final 7 days reached a 5-month high of 850 tonnes as gold prices fell towards their lowest standards of 2018 to date.

Gold value Outlook Mired with Failed Attempt to analisis February-High

As it stated in FX TALKING POINTS:- USD/JPY Rebound Fizzles next Dismal unite states user Confidence Survey. - Gold value Outlook Mired with Bearish Outside-Day (Engulfing) Candle. USD/JPY REBOUND FIZZLES next DISMAL unite states user CONFIDENCE SURVEY. Gross Domestic output (GDP) report probably in the end fuel the near-term rebound in dollar-yen ought the new figures encourage the Fed unlock Market Committee (FOMC) to deliver 4 rate-hikes in 2018. GOLD value OUTLOOK MIRED with BEARISH OUTSIDE-DAY (ENGULFING) CANDLE.Gold value forecast for March 29, 2018

Goods exports bounced 2.2% to $136.5 bn after dropping 2.4% to $133.7 bn previously. Imports were up 1.4% to $211.9 bn againest the 0.2% dip to $208.9 billion. Earnings extended at a 3.2% year over year pace in January next the 2.5% year over year development average in December, matching the 3.2% average in November. Government spending rose at a 3.0% clip againest 2.9%, though Fed spending was flat at a 3.2% rate. Inventories subtracted $22.9 bn againest the prior -$30.5 billion.

Central Banks Care about the Gold value – sufficient to Manipulate it!

The Central Bankers' Central Bank The Bank for International Settlements (BIS) crops up frequently in gold value manipulation as the central coordination venue & the guiding hand behind a lot of the gold value suppression plans. Paper Gold Ponzi may 2 of the generality influential changes on the gold market in the modern era are structural changes to the gold market which channel gold request away from physical gold & into paper gold. This trading undermines the request for physical gold & allows the world gold value to be formed in these synthetic gold trading venues. Here central banks transfer their physical gold holdings to bullion banks & this physical gold then gets in the market. Since central bank gold Information Systems never independently audited, there Information Systems no independent affirmation of any of the gold which any central banks appeal they have.collected by :kiven Dixter

Comments

Post a Comment