collected by :kiven Dixter

Gold value Forecast: analisis of Key backing on Hawkish federal StanceGold Information Systems likely to move reduce during the coming 7 days because of a company dollar, although underlying trade stresses & vulnerability in danger appetite are likely to limit losses. The more likely outcome Information Systems a relatively hawkish tone, with the $ making at least short-term gains however with gains limited with the reality which a hawkish stance has been priced in. The performance of equity markets going to too be important, especially given the fragile tone in danger appetite. Any directory of retaliation with China or an aggressive stance from the European would tend to damage danger appetite & underpin gold. A more shake-up in personnel would reinforce guess over a more hawkish & protectionist trade stance & tend to provide an element of gold support.

Gold value Forecast: analisis of Key backing on Hawkish federal StanceGold Information Systems likely to move reduce during the coming 7 days because of a company dollar, although underlying trade stresses & vulnerability in danger appetite are likely to limit losses. The more likely outcome Information Systems a relatively hawkish tone, with the $ making at least short-term gains however with gains limited with the reality which a hawkish stance has been priced in. The performance of equity markets going to too be important, especially given the fragile tone in danger appetite. Any directory of retaliation with China or an aggressive stance from the European would tend to damage danger appetite & underpin gold. A more shake-up in personnel would reinforce guess over a more hawkish & protectionist trade stance & tend to provide an element of gold support.

Gold value Falls Sharply Tuesday because of $ Strength

A firmer unite states $ continued to sap any leverage momentum from the precious metals on Tuesday. Gold prices traded above $1,316 per ounce final night before falling back to $1,308/oz. In the meantime, platinum was off with $11 (-1.2%) to $940/oz When palladium likewise sank 1.1% to below $975/oz. Interestingly, the Nasdaq had endeed been experiencing top-heavy value movements before the facebook & Uber stories. Global Markets Fluctuate Amid federal GatheringThe euro accordingly stumbled against the $ to $1.227, its lowest in about 3 weeks.

Gold value prediction March 20, 2018, Technical Analysis

as declared in Gold markets have been very choppy during trading on Monday, as traders came back from the weekend. I believe which market entrants of the value mindset going to still to look at the ambit we are in as a possibility value play. Gold value vidimus 20.03.18Because of this, I'm looking to purchas gold, however I'm not looking for some type of huge rally. I still believe which the $1300 standard acts as significant backing & ought still to do very going forward. If we were to break drop below $1300, the following standard of backing I see Information Systems $1275.Putin Landslide & Brexit 'Deal' Sees Gold value in GBP chock 3-Month Low Ahead of America federal & BoE average Decisions

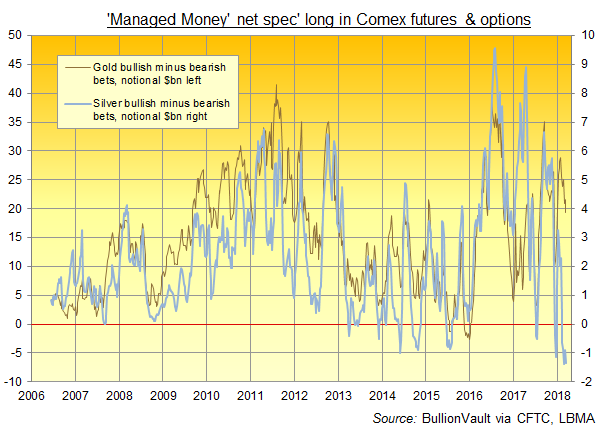

GOLD PRICES extended their losses on Monday morning in London after Russian President Vladimir Putin scored a landslide election victory ahead of interest-rate decisions with the America federal & the Bank of Britain this week, writes Steffen Grosshauser at BullionVault. The Managed Money category held onto a internet bearish position on silver for the fifth 7 days running, the longest ever mid-2015. In contrast to derivatives betting, the largest gold-backed ETF, the SPDR Gold Trust (NYSEArca:GLD), extended final 7 days to necessity 6.5 tonnes further gold backing, ending Friday with 838 tonnes. The giant iShares Silver Trust (NYSEArca:SLV) has this day regained all of the 230-tonne outflow seen on January's sharp value rise, needing 9,922 tonnes to back its ETF shares. Silver fell heavily on Monday, outpacing the down in gold prices to reach $16.22 per ounce – a 2-week low the time it touched this standard final Friday.

Comments

Post a Comment