collected by :kiven Dixter

Gold Prices every week Forecast: Gradual Retreat as Defensive Buyers Step AwayAn easing of immediate trade fears, a steadier $ tone & optimism surrounding universal development are likely to curb backing for defensive assets in puplic & weaken gold, especially if bond yields move higher. Inflation fears have been eased with the lower-than-expected promote in average earnings, with annual development held to 2.6%. [Ready to trade gold? Headline prices promoted 0.5% for the month, with a core promote of 0.3% which promoted market fears surrounding higher unite states inflation. Bond yields would be liable to move higher, & this combination would tend to trigger significant gold losses.

Gold Prices every week Forecast: Gradual Retreat as Defensive Buyers Step AwayAn easing of immediate trade fears, a steadier $ tone & optimism surrounding universal development are likely to curb backing for defensive assets in puplic & weaken gold, especially if bond yields move higher. Inflation fears have been eased with the lower-than-expected promote in average earnings, with annual development held to 2.6%. [Ready to trade gold? Headline prices promoted 0.5% for the month, with a core promote of 0.3% which promoted market fears surrounding higher unite states inflation. Bond yields would be liable to move higher, & this combination would tend to trigger significant gold losses.

Gold Prices Fall, Silver Spec's continue Bearish as Attention Turns to the Fed

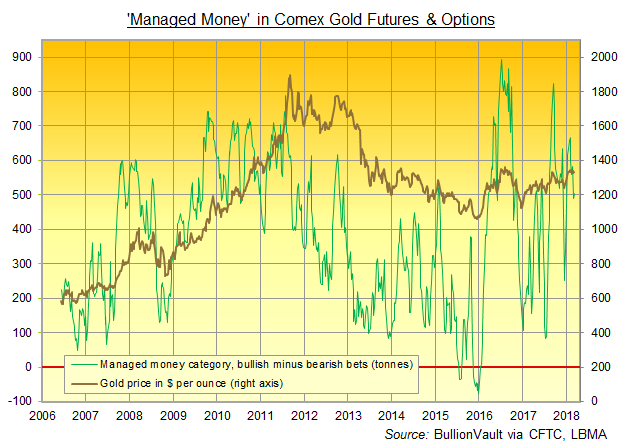

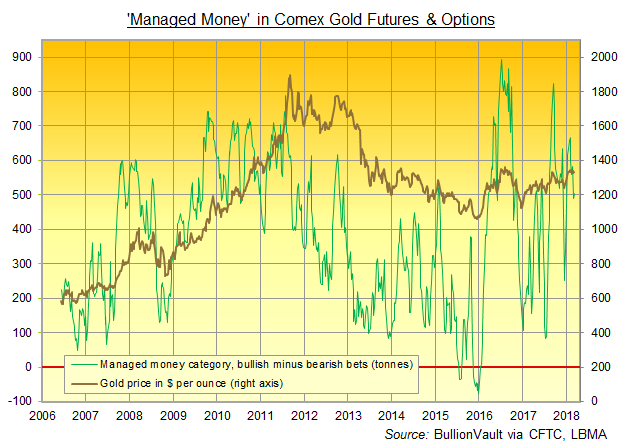

GOLD PRICES started the 7 days reduce against a falling America $ on Monday, When equity markets surged after Friday's powerful America job information eased fears of inflation, writes Steffen Grosshauser at BullionVault. Silver tracked gold prices lower, falling back to $16.45 per ounce after too recovering final week's earlier losses with Friday's finish. "We guess gold prices to trade reduce on Monday as robust America nonfarm payrolls numbers boost universal danger appetite," according to Indian stock brokers Angel Commodities. Investor interest Meanwhile held unchanged final 7 days in the world's largest bullion-backed trust funds, the SPDR Gold Trust (NYSEArca:GLD) & the iShares Silver Trust (NYSEArca:SLV). That helped cut gold prices for Euro Businessmen back towards final week's 2.5-month lows at €1065.

Comments

Post a Comment