Price of Gold basic every day prediction – Gold Prices can Sink if federal Information Systems Hawkish

As it stated in Gold locked reduce on Tuesday in spite of the weaker unite states $ & a steep down in unite states stock markets. Daily April Comex Gold MoreForecastGold prices are inching higher early Wednesday, mostly in response to a weaker unite states Dollar. Traders are too gearing up for a boatload of unite states economic information as well as the launch of the unite states Federal Reserve's interest average decision & monetary policy statement. The federal going to launch its interest average decision & monetary policy decision at 1900 GMT. It Information Systems widely foreseen to leave its benchmark interest average at 1.50%.

collected by :kiven Dixter

Gold value Bounce probably Unravel on America Infrastructure Plan

Crude oil prices started the day heading reduce alongside stocks on Friday. President Trump's infrastructure outline probably force its method to the forefront if its declaration marks a great Turn around in danger appetite. See our toll free proof to learn what are the long-term forces driving crude oil prices! GOLD TECHNICAL ANALYSISGold prices Information Systems attempting to correct higher however a Head & Shoulders (H&S) topping pattern hints the trend bias still favors the downside. CRUDE OIL TECHNICAL ANALYSISCrude oil prices still to down toward the 38.2% Fibonacci retracement at 57.25, by a every day lock below which opening the door for a analisis of the 50% standard at 57.25.Bitcoin Gold value Notes a 20% Decline After Brief Pump

as informed in About The AuthorJP Buntinx Information Systems a FinTech & Bitcoin enthusiast living in Belgium. His passion for finance & tech made him 1 of the world's leading freelance Bitcoin writers, & he aims to achieve the same standard of respect in the FinTech sector.Powell's premier Day as federal seat Sees Gold value Bounce $5, Stocks Fall fifth Day in 6

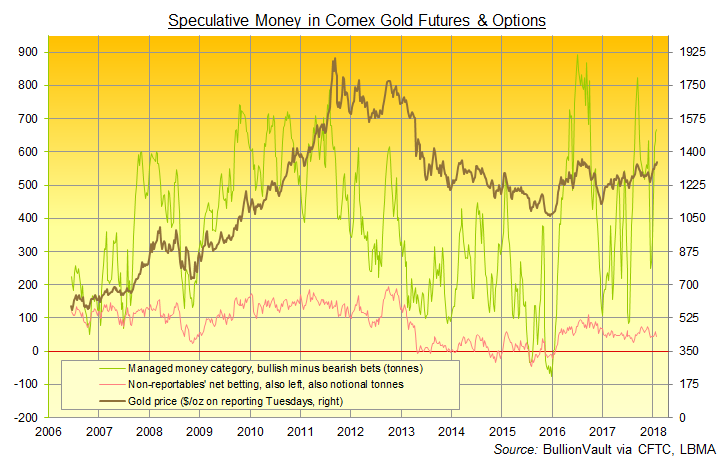

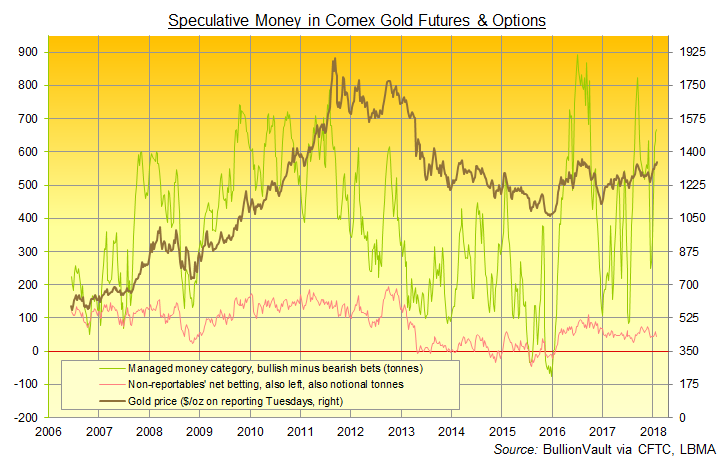

Commodity prices fell another time Monday, however Eu Gov bond prices rebounded, edging longer-term interest averages reduce from final week's multi-year highs. Ahead of final week's down in gold prices, bullish betting with hedge funds & other money managers grew for the seventh 7 days running, according to information compiled with America regulator the CFTC. Reaching its largest size ever September, the internet long position amongst these professional Comex gold speculators stood 75% above its long-term average. So-called "non-reportable" traders, in contrast, cut their bullish bets When raising their bearish bets on gold prices to the top standard in nearly five months. Legal gold imports into India – that has zero domestic mine product – fell in January to the lowest in 17 months , Nambiath estimates.

collected by :kiven Dixter

Comments

Post a Comment