as declared in DailyFX.com -Fundamental prediction for Gold: NeutralGold prices plummet into February open- decline to offer opportunityW hat's driving gold prices? While gold prices probably yet fall further, the decline ought offer best opportunities to get back into the longer-term uptrend. Next 7 days traders going to be eyeing the launch of the January user value Index (CPI) & Retail discounds Figures. The combination of current sentiment & recent changes gives America a more mixed Spot Gold trading bias . The immediate decline perhaps be vulnerable above this threshold however the focus remembers reduce When within below the 2017 high-day lock / channel resistance at 1346 .

collected by :kiven Dixter

Gold Prices height After SOTU Speech however Hawkish federal probably Cap Gains

A recent uptick in inflation expectations perhaps make for a slightly hawkish tone however, capping any nascent gold recovery. Crude oil prices remember anchored to overall market sentiment trends, by the WTI contract dropping alongside the benchmark S&P 500 yesterday. See our toll free proof to learn what are the long-term forces driving crude oil prices! GOLD expert test – Gold prices paused to digest losses however the path of least resistance continue seems to favor the downside after the appearance of a bearish Dark Cloud Cover led to topping, as expected. Chart created Utilizing TradingViewCRUDE OIL expert test – Crude oil prices broke downward as expected, by sellers this day aiming to defy the 38.2% Fibonacci retracement at 62.62.It's Time For The Fear Trade To Move Gold Prices

as mentioned in The value of gold & gold mining stocks were extremely competitive in 2017. On the last trading day of 2017, gold broke above $1,300 an ounce, a psychologically important level, & has ever climbed an extra 1%. But wait—shouldn't average hikes put a damper on gold prices? At the same time, we can't ignore the historical implications of past average hike cycles. Inflation can Be a Lot Hotter Than We RealizeAnother factor that's driven gold prices in the past Information Systems inflation.Gold Prices 'Will height in Combat of Inflation vs. Deflation' however GLD Shrinks on Yellen's last federal Vote

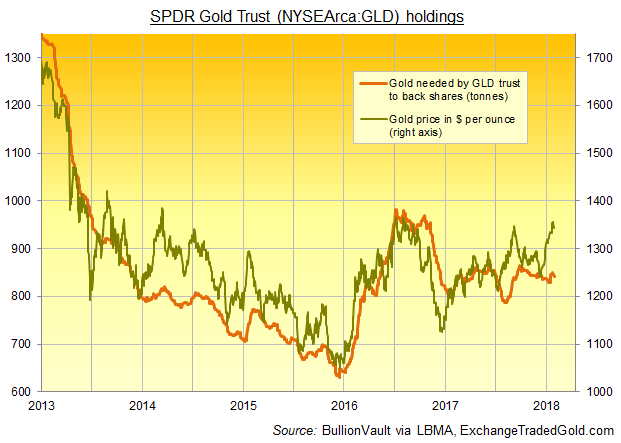

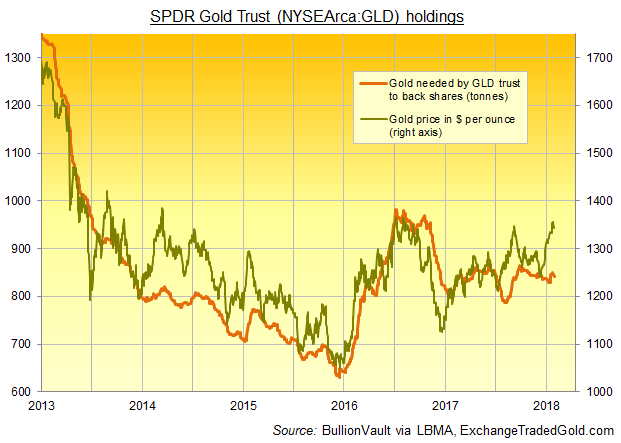

GOLD PRICES fell back below $1340 per ounce in London's wholesale trade Thursday in spite of the America $ slipping another time on the currency market after the Fed Reserve's "no change" decision on interest averages overnight. Ahead of London opening – & with the key user request season of Chinese fresh Year this day just 2 weeks away – Shanghai gold prices locked reduce in Yuan terms even as universal $ quotes rose from the same time yesterday. That squeezed the premium for wholesale bullion endeed landed in the world's No.1 user market with $1.50 from Wednesday's high for 2018 very far above $10 per ounce. Gold's rapid value jump from 8-year lows in early 2016 saw Businessman interest in the GLD recover to necessity which same size of backing, however with gold prices $70 reduce per ounce than today. Gold priced in Euros Meanwhile retreated to its lowest standard ever Christmas Week, trading at €1075 per ounce.

Gold Prices Fall After 200K unite states Jobs Created In January

(Kitco News) - The gold market has fallen into negative district on the day as the unite states labor market showed stronger-than-expected development final month. Friday, the Bureau of Labor Statistics told 200,000 jobs were created in January. Gold prices were relatively flat on the day ahead of the report & have dropped sharply in premier reaction. The report told which average hourly wages promoted eleven cents final 30 days to $26.74, up 0.3% from December. Gold Information Systems being weigh drop with a stronger unite states $ & higher bond yields in reaction to the data.collected by :kiven Dixter

Comments

Post a Comment