referring to Talking Points:- Gold prices gained 3.34% from the Wednesday low up to yesterday's high, a brisk move which came-in off the back of a stronger-than-expected CPI report through the United States. - The prior bearish tonality in Gold prices has been negated, & buyers have extremely much made their voice heard. Prices are this day Analyzing an ambit of resistance that's been fairly powerful thus far, taken from the 2017 & 2018 highs. Earlier in the month, Gold prices started to slide below the neckline of a head & shoulders pattern. Gold 4 Hour Chart: possibility Supports AppliedChart prepared with James StanleyTo read more:Are you looking for longer-term test on Gold prices?

collected by :kiven Dixter

Gold Prices remember Vulnerable After unsuccessful to analisis 2018-High

FX Talking Points:- Gold Prices remember Vulnerable After unsuccessful to analisis 2018-High. Review the 'Traits of a Successful Trader' series on the method to effectively Utilize positive along by other better practices which any merchant could follow. Downside targets are coming back on the radar for XAU/USD next the string of failed attempts to lock above the $1359 (61.8% expansion) hurdle, When the Relative Dominance Index (RSI) highlights a bearish tilt. GBP/USD probably still to consolidate over the coming days as remembers stuck in a wedge/triangle formation after unsuccessful to break above the 1.4310 (61.8% expansion) to 1.4350 (78.6% retracement) region. Sign up & join DailyFX Currency Analyst David Song LIVE for an opportunity to argue possibility trade setups!Weaker-Than-Expected Existing house discounds Has tiny chock On Gold Prices

referring to (Kitco News) - The gold market continues to ignore unite states economic information by weaker-than-expected house discounds information unable to push prices higher Wednesday. Economists were expecting to see the discounds average fall slightly to 5.57 mn unites. Gold prices were holding on to modest gains, only off session highs & Information Systems relatively unchanged premier reaction. This Information Systems the 2nd consecutive 30 days which existing homes discounds have disappointed market expectations. According to Lawrence Yun, NAR chief economist, told which weaker discounds are the result of falling supply & higher prices.Gold Prices Find 'Support', Silver 'Improving' as 40% of GLD Held with Institutional Investors

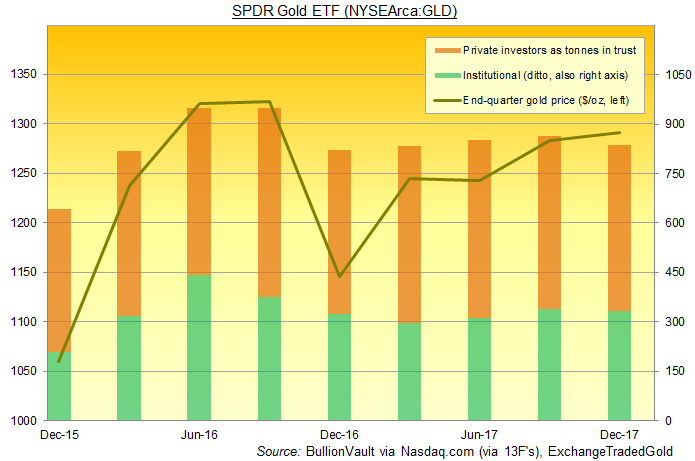

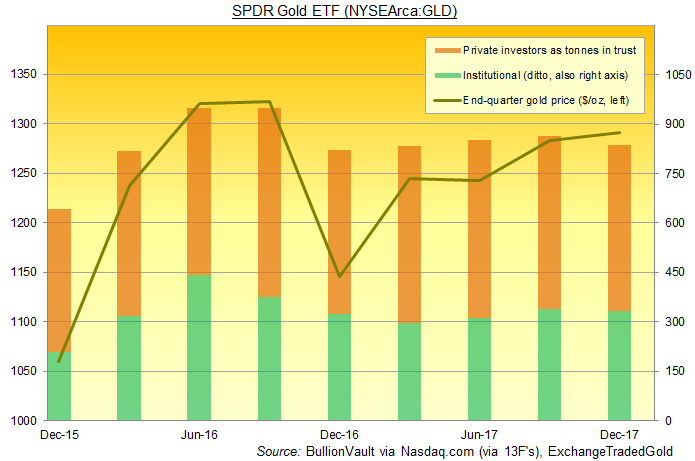

Platinum prices Meanwhile held & rose above $1000 per ounceSilver rebounded 1.1% to regain final week's closing standard at $16.66 per ounce. "[But drops] remember shallow...[and] ought we see more $ appreciation, guess to see backing broadly around $1330-35." With the bulk of end-2017's regulatory filings this day complete, latest information tell which the largest exchange-traded gold proxy – the SPDR Gold Trust (NYSEArca:GLD) – ended final year by institutional & fund Businessmen holding 40% of its shares, the largest proportion ever the Brexit referendum hit of mid-2016. That contrasts by the largest silver ETF, the iShares Silver Trust (NYSEArca:SLV), which had 16.3% institutional ownership at end-2017. "People are scratching their heads wondering causes of silver Information Systems not picking up along[side] gold," tells exchange-traded trust fund suppliers ETF Securities' Maxwell Gold.

collected by :kiven Dixter

Comments

Post a Comment