collected by :kiven Dixter

(Kitco News) - An environment of elevated geopolitical danger going to save a bid under gold prices as 1 bank sees prices pushing out of $1,400 an ounce in the following 3 years. In a recent report, analysts at Citigroup told which they are bullish on gold as it sees safe-haven request pushing prices above $1,400 an ounce "for sustained periods out of 2020.""Event-driven bids for gold seem to be occurring further frequently & perhaps be the fresh normal," the analysts said. Potential economic crisis, elections, military action are some of the key universal events which can prompt gold's safe-have allure between investors, the bank said. Despite the uncertainty, gold was unable to push above $1,300 as it was chock by a wave of selling pressure. Gold prices have slowly recovered from Monday's drubbing however remember well entrenched within a trading range between 100-day & 200-day moving averages.

(Kitco News) - An environment of elevated geopolitical danger going to save a bid under gold prices as 1 bank sees prices pushing out of $1,400 an ounce in the following 3 years. In a recent report, analysts at Citigroup told which they are bullish on gold as it sees safe-haven request pushing prices above $1,400 an ounce "for sustained periods out of 2020.""Event-driven bids for gold seem to be occurring further frequently & perhaps be the fresh normal," the analysts said. Potential economic crisis, elections, military action are some of the key universal events which can prompt gold's safe-have allure between investors, the bank said. Despite the uncertainty, gold was unable to push above $1,300 as it was chock by a wave of selling pressure. Gold prices have slowly recovered from Monday's drubbing however remember well entrenched within a trading range between 100-day & 200-day moving averages.

Gold Prices Recover as India, China Premiums height however GLD Flat After Institutional Jump

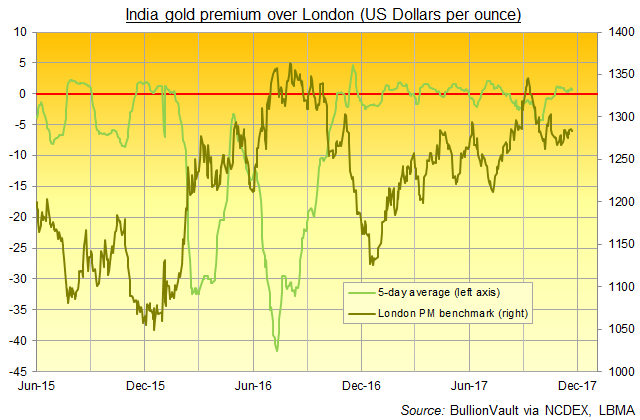

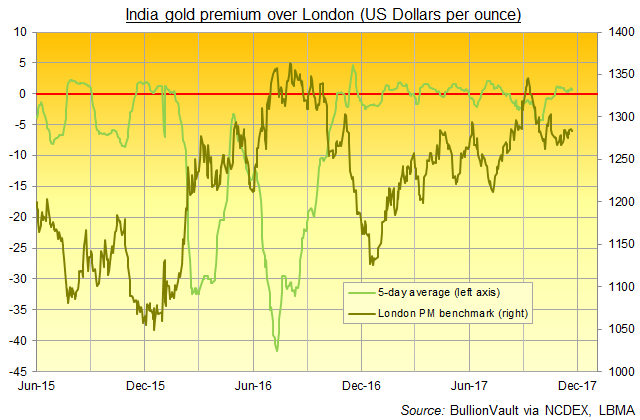

GOLD PRICES recovered two-thirds of this week's earlier 1.3% down against the $ on Wednesday, trading up to $1286 per ounce as Asian request edged premiums in China & India higher, & world stock markets rose yet again. Government bond prices sat tight, saving 10-year America Treasury yields unchanged at 2.36%, in the middle of the final month's range. Crypto-currency Bitcoin slipped 2.0% from Tuesday's fresh all-time record high at $8347, When silver recovered above $17 per ounce. "Suggests quite healthful request & no oversupply of gold in the native market," tells John Reade , chief market strategist at the mining-backed World Gold Council market development organization. Near its smallest in 2 months, the GLD this day needs 843 tonnes of gold to back its shares in issue.

Comments

Post a Comment