In the past week, gold printed a low of $1,260.7 before rebounding and closing the week just above $1,269 per ounce. Safe Haven ComparisonWe consider the Treasury Inflation Protected Securities (NYSEARCA:TIP) ETF and real interest rates to be safe haven alternatives to gold investment. Often, the gold miners will lead the precious metals complex; we cannot predict whether this is one of those times. We write regular columns on the SPRD Gold Trust (NYSEARCA: GLD) and the iShares Silver Trust (NYSEARCA: SLV) which outline our views and positioning. Our primary concerns are that gold could follow miners lower and/or fall to correct with real interest rates.

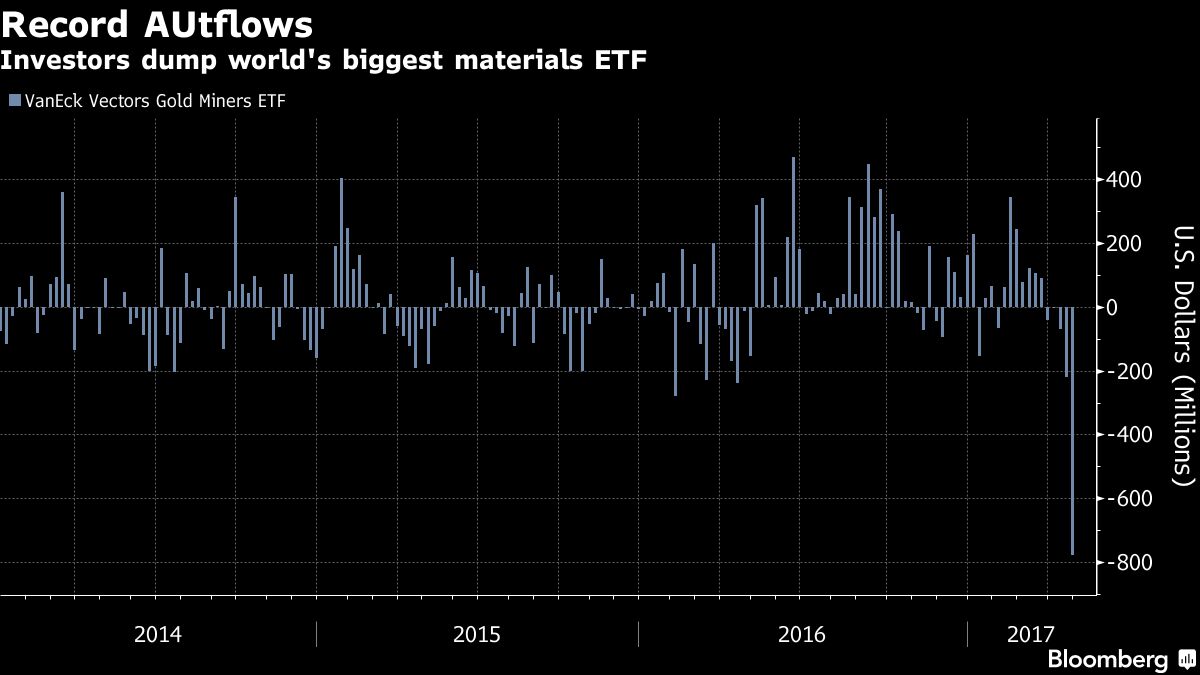

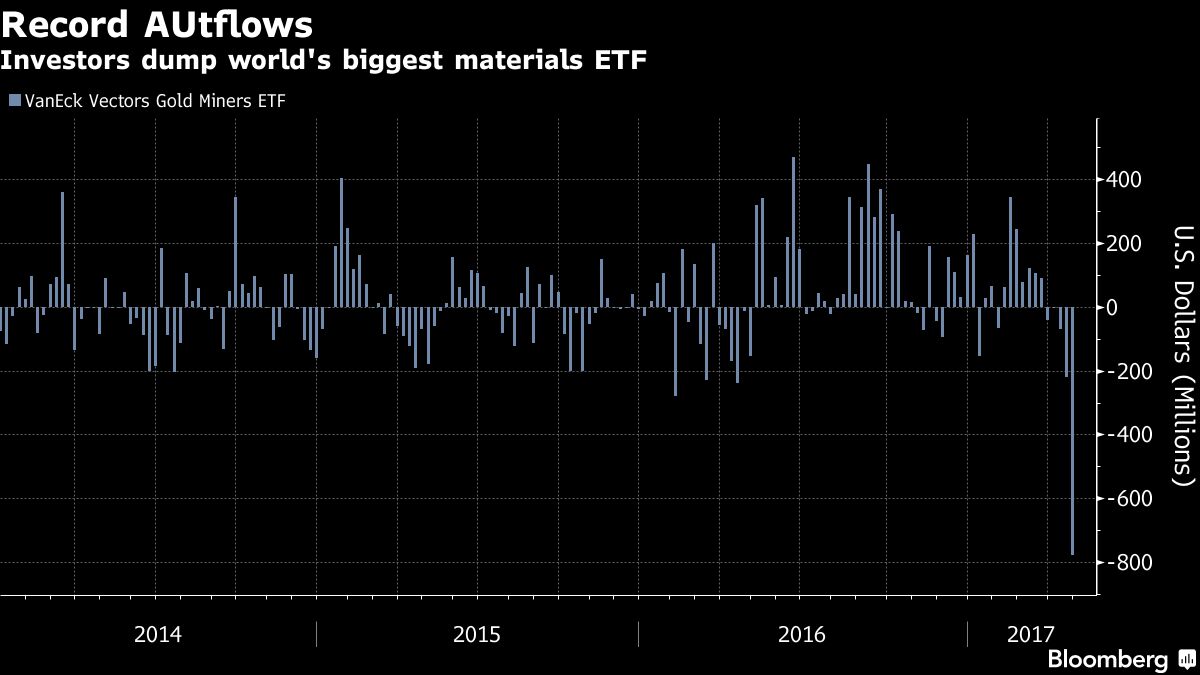

as declared in The SPDR Gold Shares ETF (GLD), the world's largest commodity ETF at $34.8 billion, also saw the most outflows among commodity funds in the period ending April 28. Investors yanked $778 million from the VanEck Vectors fund and $217 million from the SPDR Gold Shares ETF, according to data compiled by Bloomberg. The U.S. equity exchange-traded fund that experienced the largest withdrawals last week was the $10.3 billion VanEck Vectors Gold Miners (GDX), the biggest ETF that invests in gold-mining companies. "GDX is a leveraged play on gold," said Eric Balchunas, ETF analyst at Bloomberg Intelligence. Five-year real rates -- which tend to move inversely to the precious metal -- actually edged lower last week as the price of gold fell 1.3 percent.

as declared in

read more visit us gold

collected by :Jack Luxor

as declared in The SPDR Gold Shares ETF (GLD), the world's largest commodity ETF at $34.8 billion, also saw the most outflows among commodity funds in the period ending April 28. Investors yanked $778 million from the VanEck Vectors fund and $217 million from the SPDR Gold Shares ETF, according to data compiled by Bloomberg. The U.S. equity exchange-traded fund that experienced the largest withdrawals last week was the $10.3 billion VanEck Vectors Gold Miners (GDX), the biggest ETF that invests in gold-mining companies. "GDX is a leveraged play on gold," said Eric Balchunas, ETF analyst at Bloomberg Intelligence. Five-year real rates -- which tend to move inversely to the precious metal -- actually edged lower last week as the price of gold fell 1.3 percent.

as declared in

Gold Miners Appear Oversold, Could Now Be The Time To Swoop In? - VanEck Vectors Gold Miners ETF (NYSEARCA:GDX)

VanEck Vectors ETF Trust - VanEck Vectors Gold Miners ETF (NYSEARCA:GDX) has had a rough 2 weeks and was down as much as 13% since hitting its most recent highs of around $25. The solid fundamental factors supporting gold prices could persist, and coupled with geopolitical uncertainties might propel gold miners significantly higher. This sort of policy places an additional support level underneath gold prices as continued inflation should propel gold higher, while a dovish adjustment in FED policy could also be favorable for gold prices. Gold miners naturally make more money when gold prices are high, so why the steep correction considering Gold's modest 3% pullback? The Backdrop for Gold PricesThere are several favorable fundamental factors that could support gold prices going forward.

read more visit us gold

collected by :Jack Luxor

Comments

Post a Comment