The VanEck Vectors Gold Miners ETF (NYSE:GDX) closed at $22.20 on Friday, up $0.27 (+1.23%). In order to get a sense for the strong support levels, I use a daily line chart which helps to smooth out the volatility. For the entire week, GDX and GDXJ declined 8% and nearly 12% respectively. The miners essentially have two points of strong support. If that target area fails to hold for a few days or even a week then look for strong support at the December lows.

As it stated in

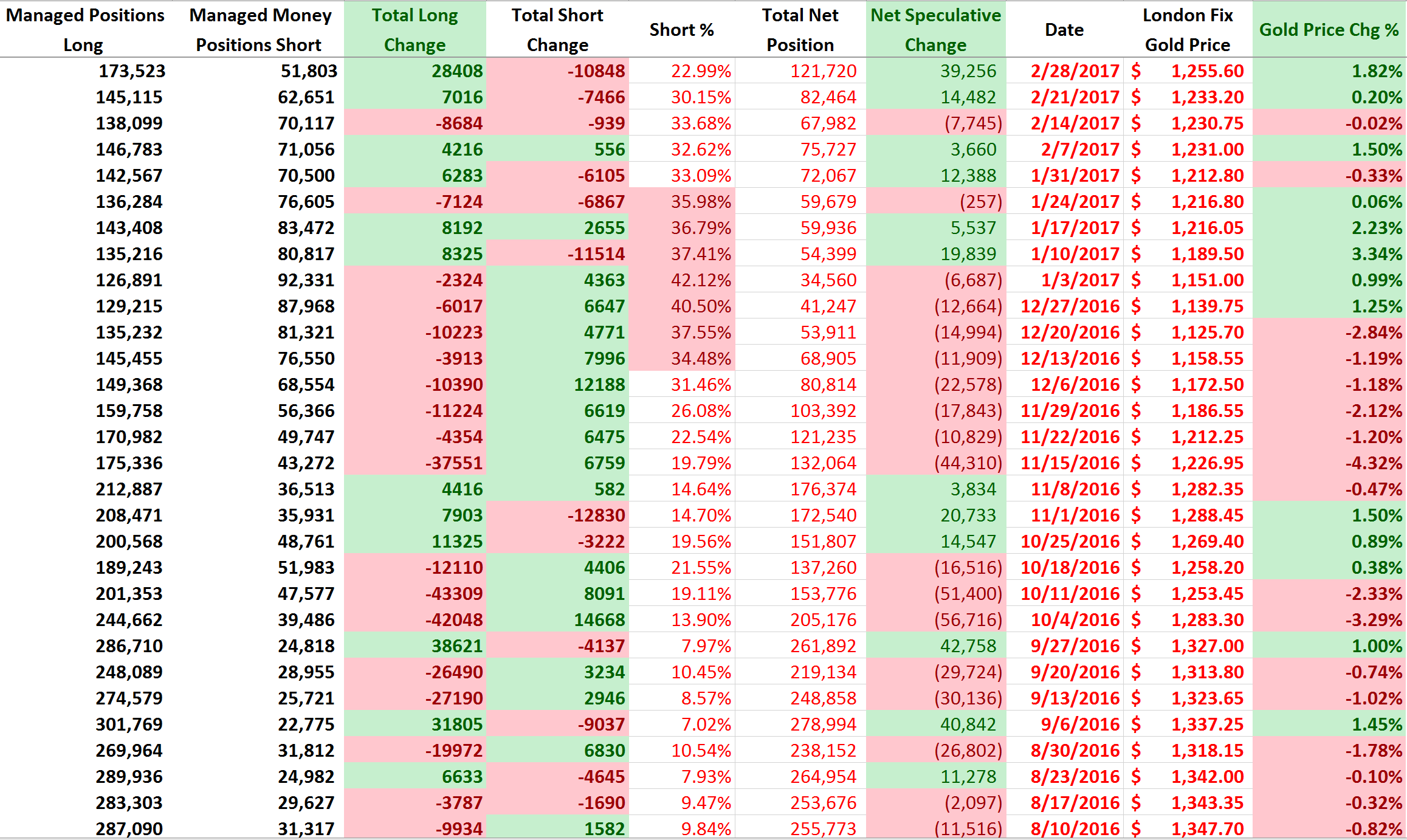

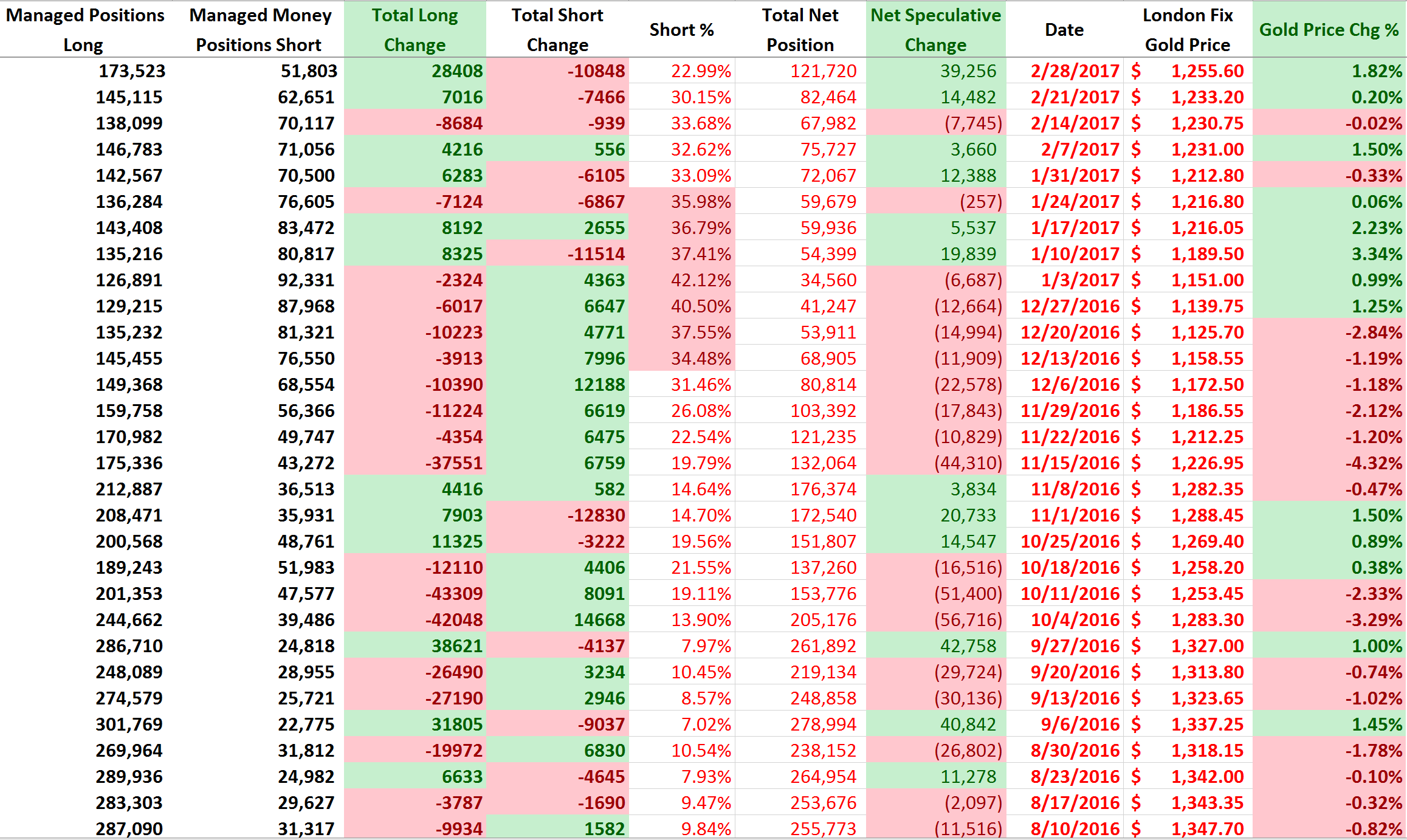

The Federal Reserve is almost certain to raise rates in March and the gold market doesn't seem to be fully pricing it in. The silver market is very over-bought and with weak silver retail sales, we think its primed for an even greater potential drop. The major news in the gold market this week was the number of Fed speakers that came out in favor of an interest rate increase during the March meeting. For silver, positions in the iShares Silver Trust (NYSEARCA:SLV), ETFS Silver Trust (NYSEARCA:SIVR), and Sprott Physical Silver Trust (NYSEARCA:PSLV) are all ways to invest. This Week's Gold COT ReportThis week's report showed another increase in speculative gold positions as longs increased their positions by 28,408 contracts, while speculative shorts cut their own positions by 10,848 contracts.

read more visit us gold

collected by :Jack Luxor

As it stated in

SPDR Gold Trust (ETF)(NYSE:GLD): New Bear Market Forming?

COT data has been instrumental in guiding us and helping us navigate market conditions during a bull and bear market. Since December, prices have recovered about half, while net long positions only reached 164K, which is a bear market value. But for newcomers, here is a detailed breakdown:A bull market attracts speculators, and the net long positions at both tops and bottoms are significantly higher of those in a bear market. However, the sharp sell off into December reduced the net long positions to 96K, which was much lower than average bull market value at bottoms. The latest COT data is quite alarming, and has our full attention going forward.

The Federal Reserve is almost certain to raise rates in March and the gold market doesn't seem to be fully pricing it in. The silver market is very over-bought and with weak silver retail sales, we think its primed for an even greater potential drop. The major news in the gold market this week was the number of Fed speakers that came out in favor of an interest rate increase during the March meeting. For silver, positions in the iShares Silver Trust (NYSEARCA:SLV), ETFS Silver Trust (NYSEARCA:SIVR), and Sprott Physical Silver Trust (NYSEARCA:PSLV) are all ways to invest. This Week's Gold COT ReportThis week's report showed another increase in speculative gold positions as longs increased their positions by 28,408 contracts, while speculative shorts cut their own positions by 10,848 contracts.

read more visit us gold

collected by :Jack Luxor

Comments

Post a Comment