Following the July highs, precious metals moved retraced some of their 2016 gains, and in a repeat performance to 2015, they reached bottoms in late December. The rally of 2017 pausesIt has been a rough start to March for precious metals. Rising inflationary pressures, political and economic shocks, and fear and uncertainty in markets tend to make precious metals attractive for investors. Precious metals were off to the races during the first two months of 2017, but the rallies have run out of steam. Another sign of weakness in the precious metals sector has been the price relationship between silver and gold.

as informed in

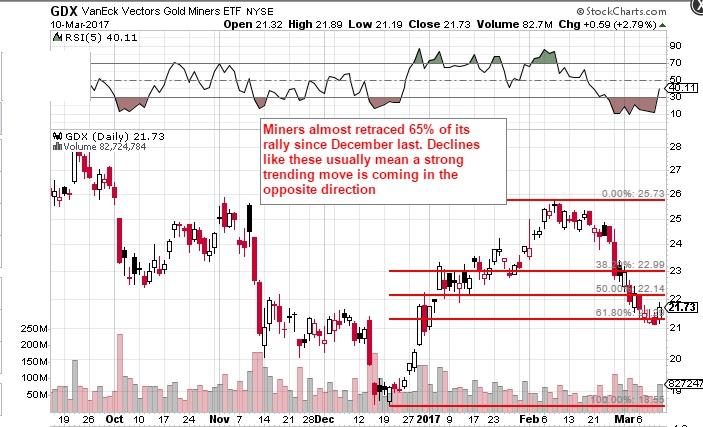

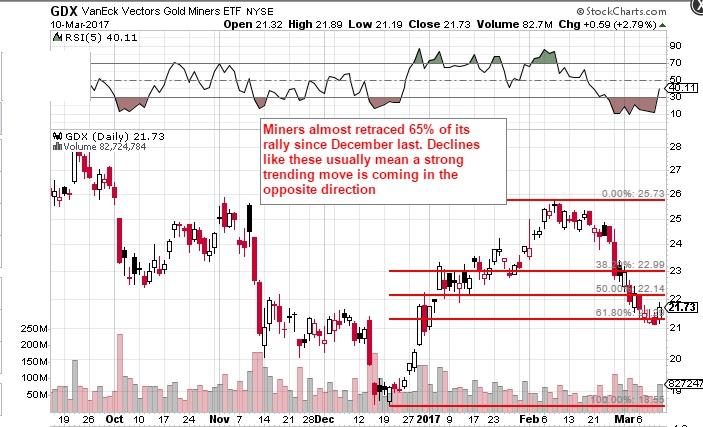

Miners receded almost 65% of their rally since December, which is in fact more indicative of an intermediate cycle low and not a daily cycle low. However, the last intermediate cycle low lasted 28 weeks, which meant it stretched quite a bit. We will know soon enough whether a short-term trap is on the cards or a brand new intermediate cycle. I do acknowledge that short cycles that sometimes follow stretched cycles, but 12 weeks seem incredibly short for an intermediate cycle. We definitely are low enough sentiment-wise to warrant an intermediate low, but further verification is needed.

read more visit us gold

collected by :Jack Luxor

as informed in

Gold And Silver's Drop Has Hit Precious Metals Investors Hard - Is It Time To Buy?

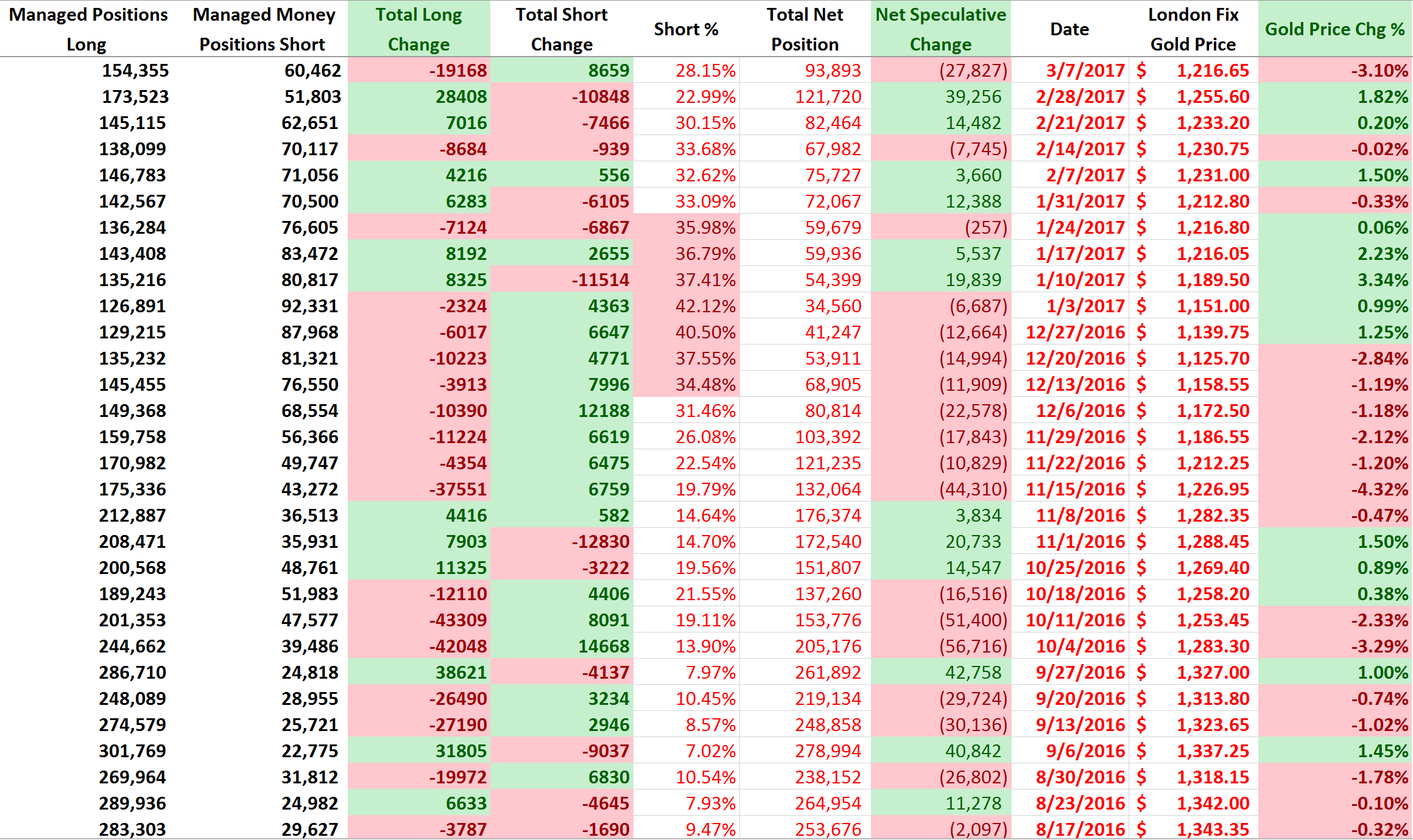

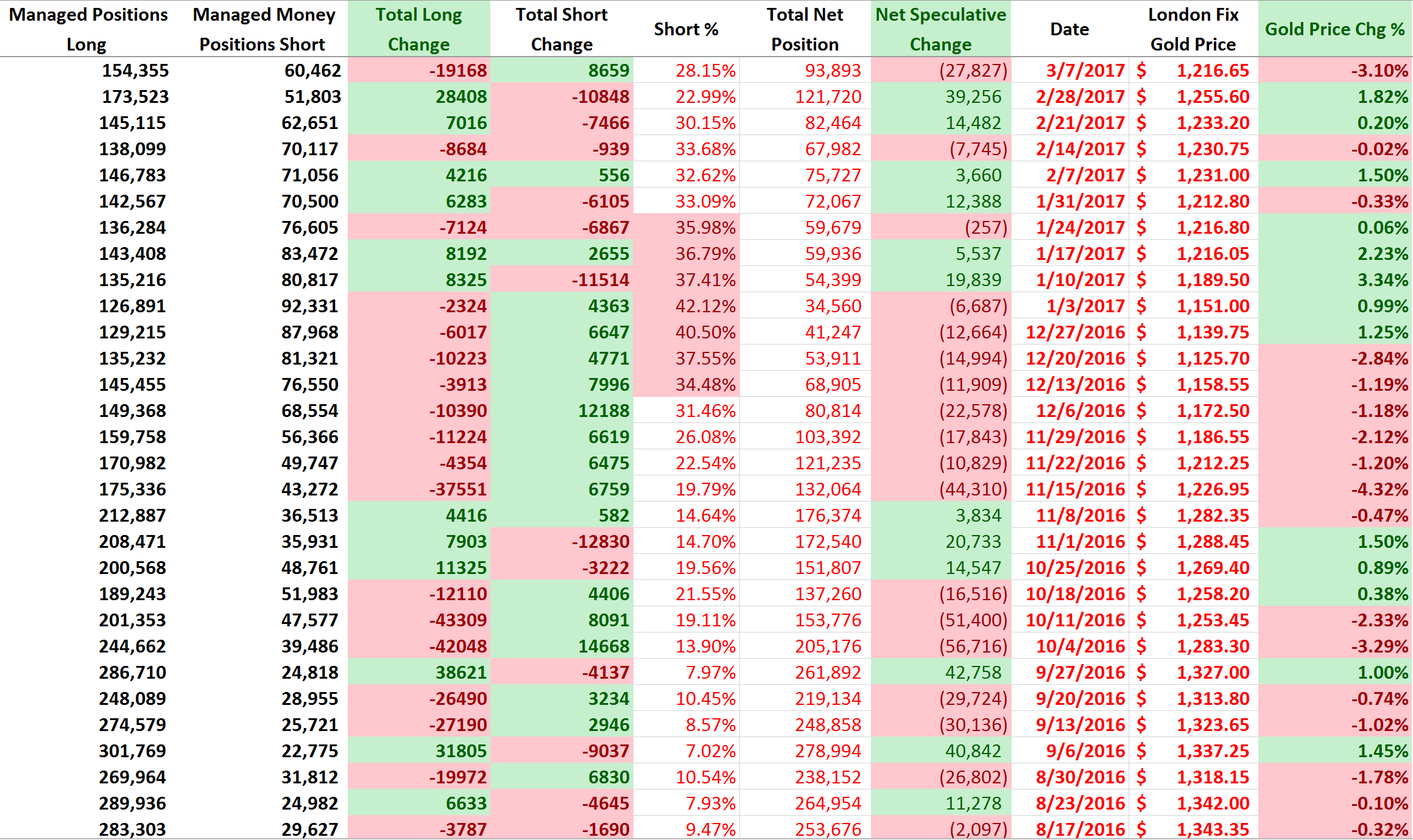

Our short-term position of gold is shifting from a bearish position that we have had over the past few weeks to a more neutral short-term position. Speculators sold off gold positions with the price drop but we still remain fairly high compared to historical net long positions at this price level. Investors need to remember that while speculators can easily push around the gold market with billion-dollar paper gold trades, the physical market is what underlies the paper market and it is many degrees smaller. But there were some green shoots for gold bulls as evidently physical demand in China and India both started to pick up signified by rising premiums in the physical gold market. Rising physical market premiums also mean that we have a margin of error when dipping our toes back into the gold market with short-term trades.

Miners receded almost 65% of their rally since December, which is in fact more indicative of an intermediate cycle low and not a daily cycle low. However, the last intermediate cycle low lasted 28 weeks, which meant it stretched quite a bit. We will know soon enough whether a short-term trap is on the cards or a brand new intermediate cycle. I do acknowledge that short cycles that sometimes follow stretched cycles, but 12 weeks seem incredibly short for an intermediate cycle. We definitely are low enough sentiment-wise to warrant an intermediate low, but further verification is needed.

read more visit us gold

collected by :Jack Luxor

Comments

Post a Comment