Click to get this free reportSPDR-GOLD TRUST (GLD): ETF Research ReportsISHARS-GOLD TR (IAU): ETF Research ReportsPWRSH-DB US$ BU (UUP): ETF Research ReportsISHARS-SLVR TR (SLV): ETF Research ReportsTo read this article on Zacks.com click here. Both the SPDR Gold Shares GLD and iShares Gold Trust IAU are at their highest levels of the year, and are actually outperforming the S&P 500 since the start of 2017. The commodity typically moves in the opposite direction of the U.S. dollar, so gold prices rise when the dollar is weak. Gold, perhaps one of the most stable commodities, is many investors' favorite when there is uncertainty in the market. Because gold is traded in dollars, the value of gold won't fluctuate.

according to

What also must be noted is the fact that gold ETFs are not the only winners in this scenario. Market participants sent almost $1.6 Billion dollars into ten of the most attractive gold ETFs on the market. This scenario has unfolded time and time again throughout history and we are once again seeing it happen, especially in the case of the king of metals: gold. GLD currently has an ETF Daily News SMART Grade of B (Buy), and is ranked #3 of 33 ETFs in the Precious Metals ETFs category. From Nathan McDonald : Precious metals have long stood the test of time.

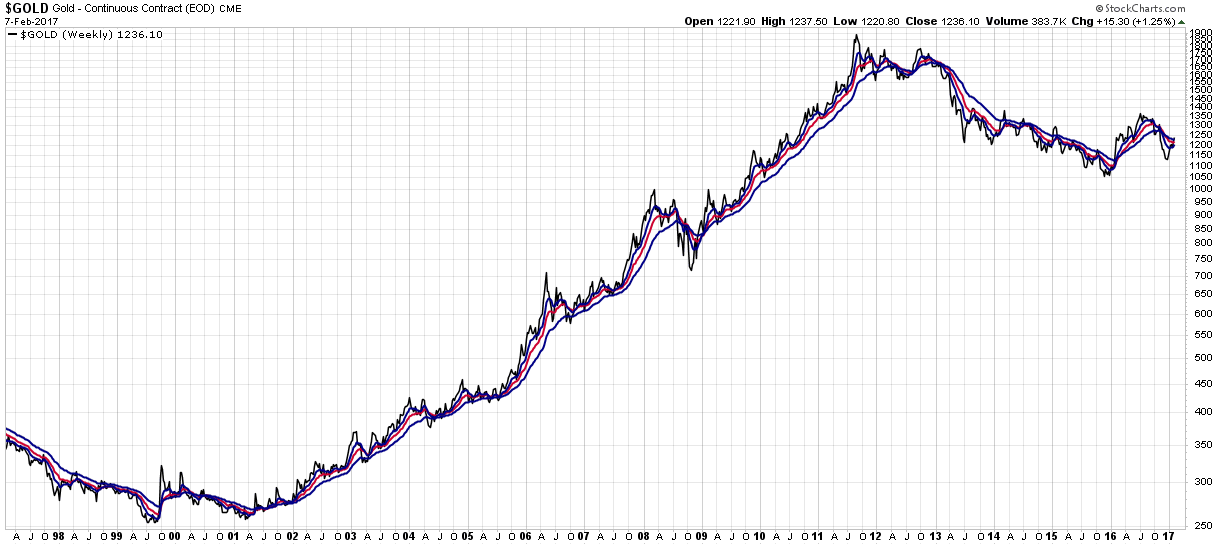

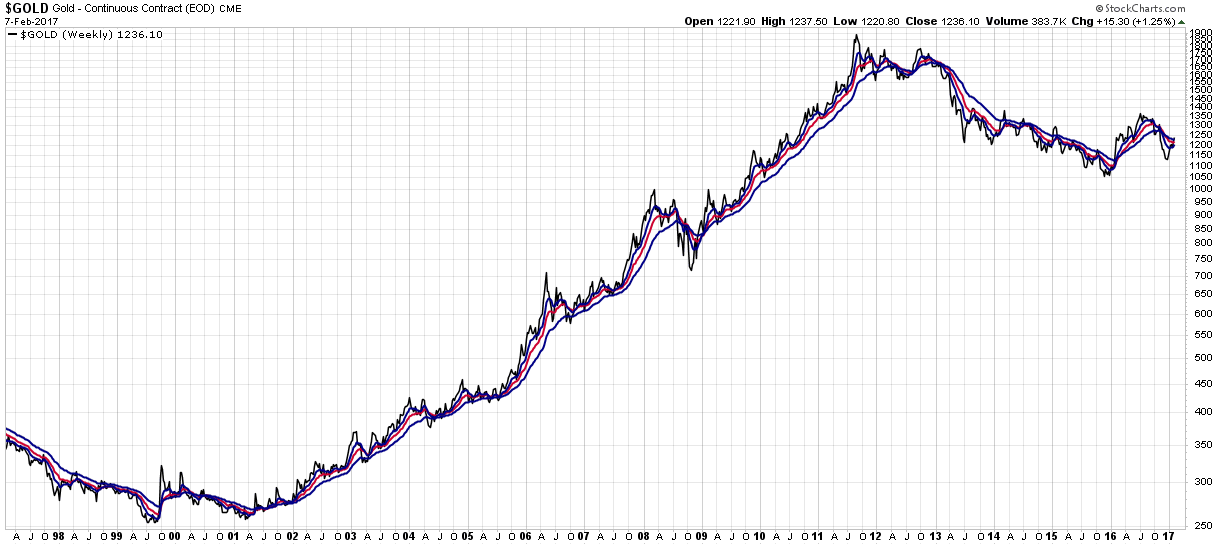

It is an unpopular opinion, but gold prices may be headed lower, which could push equities to historic levels. The "new normal" narrative sounds nice, but asset markets do not function at zero or negative rates, it is simply unjustified. This ultimately means that gold prices are extremely elevated in U.S. dollar terms. All of this spells trouble for gold and gold bugs alike. Gold has been unable to recapture its 2012 highs the past few years as the environment turns negative for the metal.

read more visit us gold

collected by :Jack Luxor

according to

SPDR Gold Trust (ETF)(NYSE:GLD): Trump Fears Spur Gold Buying Frenzy

What also must be noted is the fact that gold ETFs are not the only winners in this scenario. Market participants sent almost $1.6 Billion dollars into ten of the most attractive gold ETFs on the market. This scenario has unfolded time and time again throughout history and we are once again seeing it happen, especially in the case of the king of metals: gold. GLD currently has an ETF Daily News SMART Grade of B (Buy), and is ranked #3 of 33 ETFs in the Precious Metals ETFs category. From Nathan McDonald : Precious metals have long stood the test of time.

It is an unpopular opinion, but gold prices may be headed lower, which could push equities to historic levels. The "new normal" narrative sounds nice, but asset markets do not function at zero or negative rates, it is simply unjustified. This ultimately means that gold prices are extremely elevated in U.S. dollar terms. All of this spells trouble for gold and gold bugs alike. Gold has been unable to recapture its 2012 highs the past few years as the environment turns negative for the metal.

read more visit us gold

collected by :Jack Luxor

Comments

Post a Comment